Improve Throughput of Your Daily VaR and xVA Calculations

Get more out of your on-premises and cloud-based compute grids by migrating your VaR and xVA calculations to take advantage of Signaloid's UxHw® technology. Support more financial products, build more detailed risk and interest rate models, run scenarios more frequently, and reduce both compute infrastructure capital expenses and compute operating costs.

With speedups of over 1000x while maintaining the same accuracy as Monte Carlo, real-time risk calculations and fine-grained risk calculations at the level of individual trades becomes a possibility.

Signaloid's UxHw® technology makes it easier to implement and faster to run quantitative risk calculations for use cases where you today use Monte Carlo methods. Augment your existing CPU- and GPU-optimized C/C++ implementations with components running on Signaloid's UxHw-enhanced compute platform. Build higher-accuracy risk models, more sophisticated portfolio valuation models, and more advanced interest rate models. Or simply run your existing models faster and more efficiently.

Increase throughput of risk calculations while enabling improved model sophistication

Completing your daily overnight VaR, xVA, and PV calculations are essential for quantitative risk estimation, but their Monte Carlo computations are expensive and slow. Migrate parts of your VaR, xVA, PV, and interest rate models to run over Signaloid's UxHw technology with up to 1000x speedups, enabling you to:

Support more financial products with risk analyses

Reduce computing infrastructure costs

Run more detailed models

Increase analysis frequency

Join the growing number of institutions moving to real-time risk and per-trade risk analysis

Over

0x

0x

Fewer than

0h

0h

Over

0%

0%

reduction in software implementation cost for interactive applications*

*Factor reduction in non-recurring engineering (NRE) software implementation cost based on Constructive Cost Model (COCOMO) cost estimation methodology. The reduction is an underestimate as the calculation does not include additional modifications required to the Monte Carlo implementation, such as GPU parallelization, that would be required to run the application interactively in real time.

Solutions

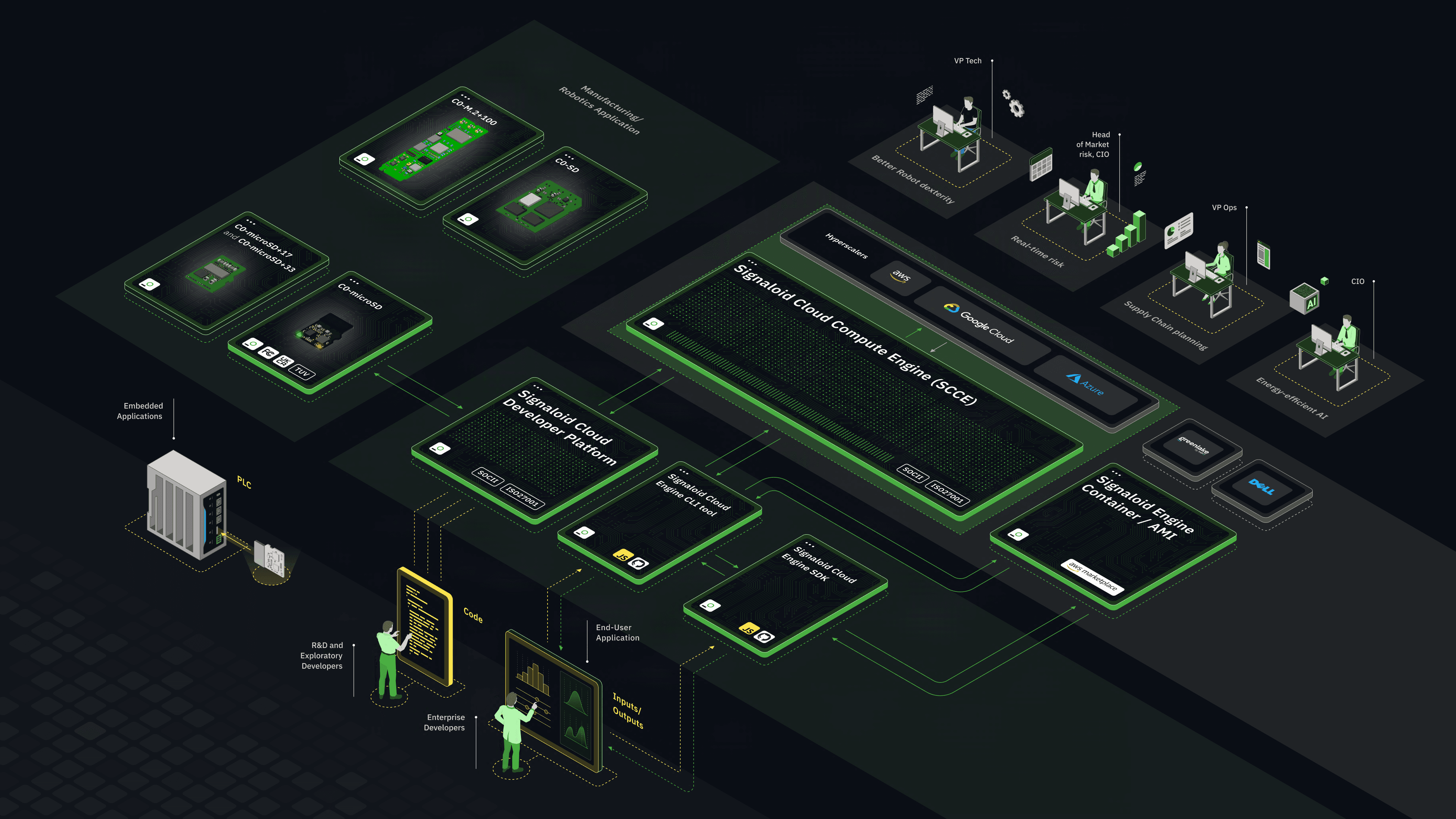

Choose between running computations on our cloud-based compute engine or on your current on-premises infrastructure.

Example Performance Validation

Speed up your existing AWS EC2 or on-premises deployments by over 1000x, while achieving the same level of accuracy as your existing deployments, by deploying Signaloid’s UxHw virtualization layer on top of existing hardware. Achieve even greater speedups using UxHw hardware accelerator cards. Give your existing optimized quant libraries an additional boost, by integration with your existing compilers and numerics libraries.

Technology Explainers

Signaloid's UxHw technology is the easiest way to implement solutions to computing problems currently addressed using Monte Carlo methods. It is also the fastest way to execute these workloads, providing speedups from 2x to over 500x (or more) across relevant quantitative finance workloads. UxHw achieves these capabilities through its facility for deterministic and efficient arithmetic on probability distributions. And because it is available as either a virtual CPU or as hardware accelerator modules, adoption is easy: It complements existing CPU and GPU hardware and optimizations already implemented in your quantitative finance libraries. The technology explainers below provide further details on how this technology benefits quantitative finance applications, from the underlying mathematics to the engineering implementations.